Subject to the Third Schedule Amendment 2016. Employees Provident Fund EPF announces the reduction in the employees monthly statutory contribution rate from 11 to 8 for members below age 60 and 55 to 4 for those age 60 and above.

Epf Interest Rate From 1952 And Epfo

If the finance minister takes the Economic Survey 2016 suggestions seriously then there may be changes in the compulsory employee contribution to EPF on the anvil.

. Employees Pension Scheme 1995 replacing the Employees Family Pension Scheme 1971 EPS Table below gives the rates of contribution of EPF EPS EDLI Admin charges in India. The employee can pay at a higher rate and in such case employer is not under any obligation to pay at such higher rate. Reduction in Employees EPF Statutory Contribution Rate 2016 The EPF Board Malaysia has announce a decrease of Employee Contribution Rate from 11 to 8 while for Senior Citizen it will be changed from 55 to 4.

From April 2016 a maximum Rs 15 lakh will be allowed per employee said Balwant Jain tax expert. The Budget also put restrictions on the quantum of EPF contribution that employers can claim as business expenses. Subject to the Third Schedule Amendment 2016.

Following the row that erupted over the governments proposed move to tax Employees Provident Fund withdrawals and restrict contributions by employers finance minister Arun Jaitley on Wednesday said he would respond to all the concerns that have been raised in his reply to the discussion on the Budget in the HouseWhen the debate comes up in. The employer must pay their employees contributions on or before the 15th of the following wage month. CPF Contribution Rate From 1 January 2016 Table for Private Sector Non-Pensionable Employees Ministries Statutory Bodies Aided Schools.

Employees total wages for the calendar month Total CPF contributions Employers Employees share Employees share of CPF contributions 55 500 to 750 below 50 Nil Nil 50 to. EPF- 367 EPS- 833 EDLI- 05 EPF EPS Administrative Charges- 11 EDLI Admin. In 2015 you as the EMPLOYEE would have 11 of your salary deducted.

As many of you mentioned that the contribution of employer is 1336 but I know that the contribution of employer is 1361. This KBA 2484659 was created specially to elaborate on the above legal change on top of the SAP solution Note. Employee EPF contribution RM 6600 8 RM 528 Note.

For members below age 60 and 55 to. EMPLOYEES PROVIDENT FUND ACT 1991. The rate of monthly contributions specified in this Part shall apply to the following.

Mac 2016 salarywage up to December 2017. Your mandatory contribution is calculated based on your monthly salary as an employee in accordance with the Contribution Rate Third Schedule. EPF announces the reduction in the employees monthly statutory contribution rate from 11 to.

The survey has suggested that employees could be allowed to choose whether or not to save 12 per cent of their salary. Employeesmembers age 60 to 75. The employees contribution rate is reduced by 15 per cent from 55 per cent to 4 per cent.

2274897 - 2274897 - LC. The new provisions indicates that if the EPF is not used for buying an annuity then 60 of that portion of the corpus which is built. Currently the EMPLOYER has a set rate of 12 each month that MUST be sent to your EPF account.

For those age 60 and above effective March 2016 until December 2017 salary. In such case employer has to pay administrative charges on the higher wages wages above 15000-. PAYE tax rates thresholds and codes.

The EPF contribution rate for the financial year 2021 is 85. Employer Employee Contribution RM RM RM RM RM From 52001 to 54000 7100 6000 13100 From 54001 to 56000 7300 6200 13500. The latest contribution rate for employees and employers effective January 2019 salarywage can be referred in theThird Schedule.

Till now withdrawal of EPF corpus after 5 years of continuous service was fully tax exempt. 20 on annual earnings above the PAYE tax. The interest rate is decided after discussion between the Central Board of Trustees of EPFO and the Ministry of Finance at the end of every financial year.

The employees contribution rate is reduced 3 per cent from 11 per cent to 8 per cent. Know How steps in a few scenarios in accordance to the above legal change. Employee provident fund AC 1 12.

To pay contribution on higher wages a joint request from Employee and employer is required Para 266 of EPF Scheme. As of now employers claim the full contribution to the EPF as a business expense. In 2016 the government has decided to reduce the EMPLOYEE contributions down to 8 hence you will end up with 3 more in your payslip each and every month.

Employees Provident Fund. Monthly contributions are made up of the employees and employers share which is paid by the employer through various methods available to them. Even if PF is calculated at higher amount For EPS we will take 15000 limit only.

EPF Employee Contribution Rate effective 01032016 - 31122017. RATE OF MONTHLY CONTRIBUTIONS PART A 1. In Many Companies Employee and Employer are Paying PF on higher amount of 20000.

The Employees Provident Fund EPF informs that the reduction of the statutory contribution rate for employees share to eight 8 per cent which started for March 2016 wagesalary April contribution will end at the end of December 2017 wagesalary January 2018 contributionThe reduction of contribution rate was announced by the Government in 2016. By Suraj Goel Prima facie the Budget 2016 has proposed making 60 of employee contribution EPF corpus taxable for contributions after 142016. Will Budget 2016 bring changes in the compulsory employee contribution to EPF.

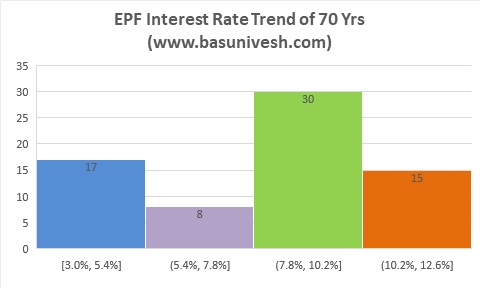

The break up is delineated below. Given below is a list of interest rates of some of the previous years-.

Tds Applicability And Rates Tax Deducted At Source Part 2 Tax Deducted At Source Rate Tax

Tds Applicability And Rates Tax Deducted At Source Part 2 Tax Deducted At Source Rate Tax

Latest Pf Interest Rate And The Procedure To Calculate Pf Interest

Cash Management Guidelines Ministry Of Finance Clarification Dtd 17th February 2021 Cash Management Management Finance

Pin On Excel Utility To Prepare Ecr Ii

Latest Pf Interest Rate And The Procedure To Calculate Pf Interest

Confluence Mobile Community Wiki

Epf Interest Rate Check Current Interest On Pf Account 2022

Epf Admin Charges Reduced From April 2017 Updated Epf Rates Simple Tax India

Highlighted The Various Break Even Points In Terms Of Deductions In Blue Therefore If Your Actual Deductions Are Greater Than Budgeting Personal Finance Tax

Confluence Mobile Community Wiki

Epf New Employee Minimum Statutory Contribution Rate On Ya2021 Yau Co

Epf Interest Rate Fy 2021 22 Historical Epf Rates 1952 To 2022 Basunivesh

Confluence Mobile Community Wiki

Income Tax Ppt Revised Income Income Tax Tax

Epf Interest Rates 2022 Epfo Cuts Interest Rates From 8 5 To 8 1

Epf Interest Rate 2021 22 How To Calculate Interest On Epf

Epf Interest Rate Fy 2021 22 Historical Epf Rates 1952 To 2022 Basunivesh